last date of linking pan with adhar card: what if not done

June 30 is the last day to link PAN with Aadhaar Card. The income tax department made it compulsory for every PAN card holder to link their PAN with Aadhaar Card. Here is what you need to know about it:

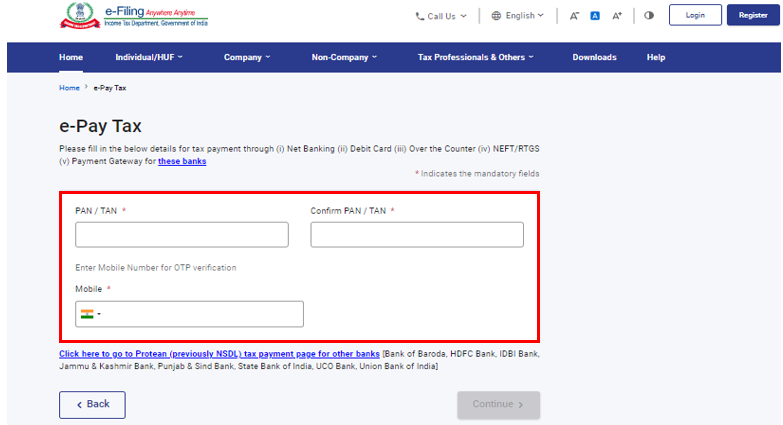

step 4) Enter your PAN , confirm PAN and any Mobile number to receive OTP

What if you don't link Aadhar with PAN

As per Income Tax Department, if you don't link PAN with Aadhar Card, then your PAN card will become inoperative or useless. PAN is one of the most important identity in security market.

Why linking PAN with Aadhar Card?

Income Tax Department announced the linking of PAN with Aadhar after certain instances of duplicates in CBDT's PAN database. Also multiple accounts were created with the same PAN card.

Who are not required for linking PAN with Aadhar Card:

1) a person of 80 years age or above

2) a person who is not citizen of India

How to link PAN with Aadhaar Card

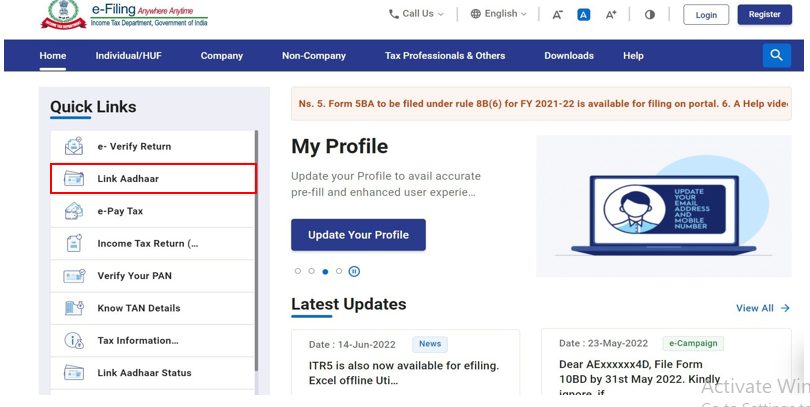

step 1) visit e-Filling portal home page and click on link Aadhaar available in quick links.

step 2) then enter your PAN and Aadhaar number

step 3) now click on pay through E-pay Tax

step 5) after OTP verification , you will be redirected to e-pay tax page and press on continue

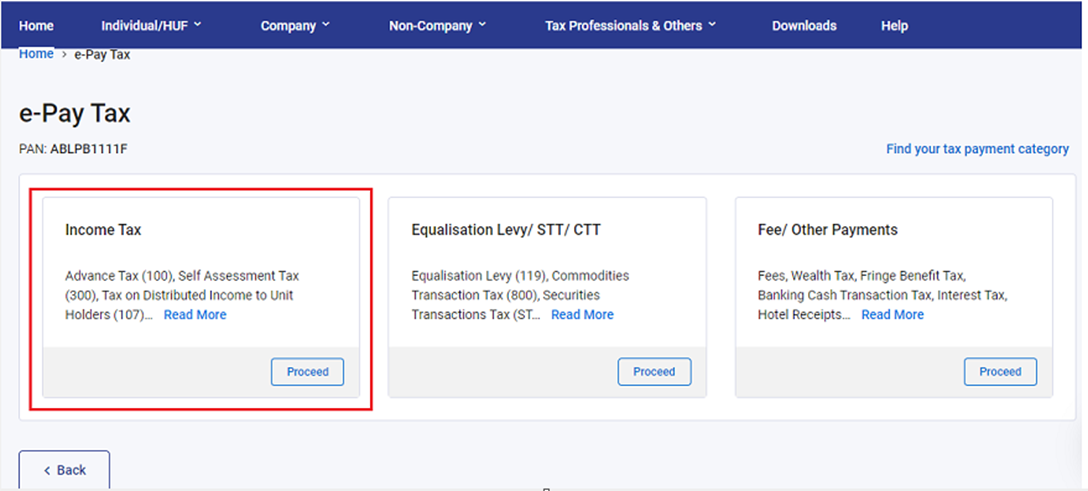

step 6) now click on Income Tax

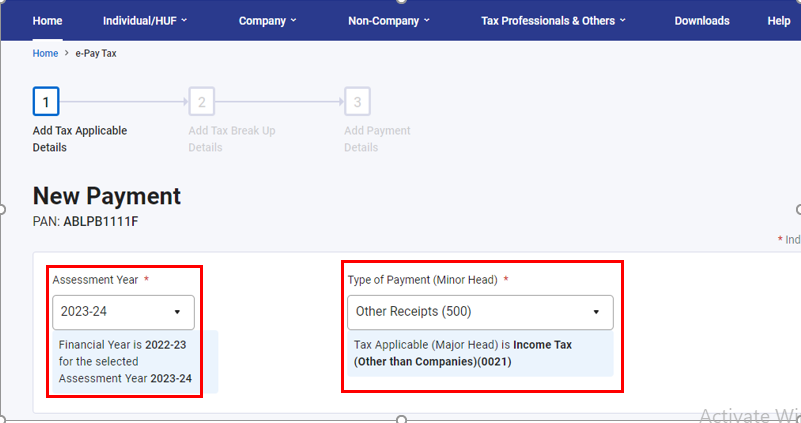

step 7) select AY (2023-24) and other receipts as payment type, then continue

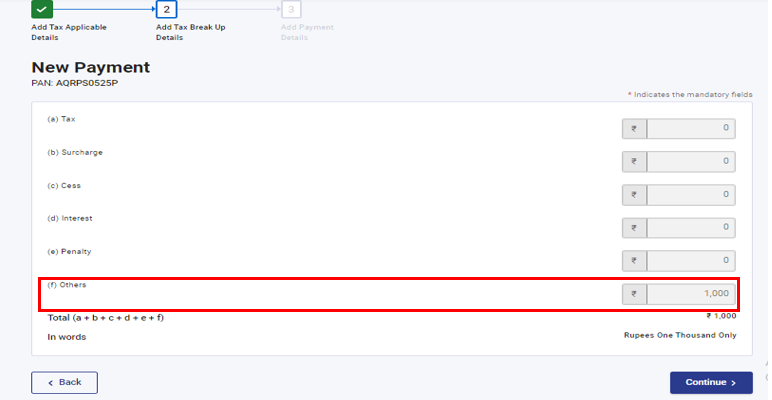

step 8) now make the payment for the others category

challan will be generated. Now you have to select the mode of payment, then you will be redirected to Bank website. You can choose either bank for online payment, not necessarily a bank where you have an account. It will redirect to your account and you can pay through UPI or net banking.

Comments

Post a Comment